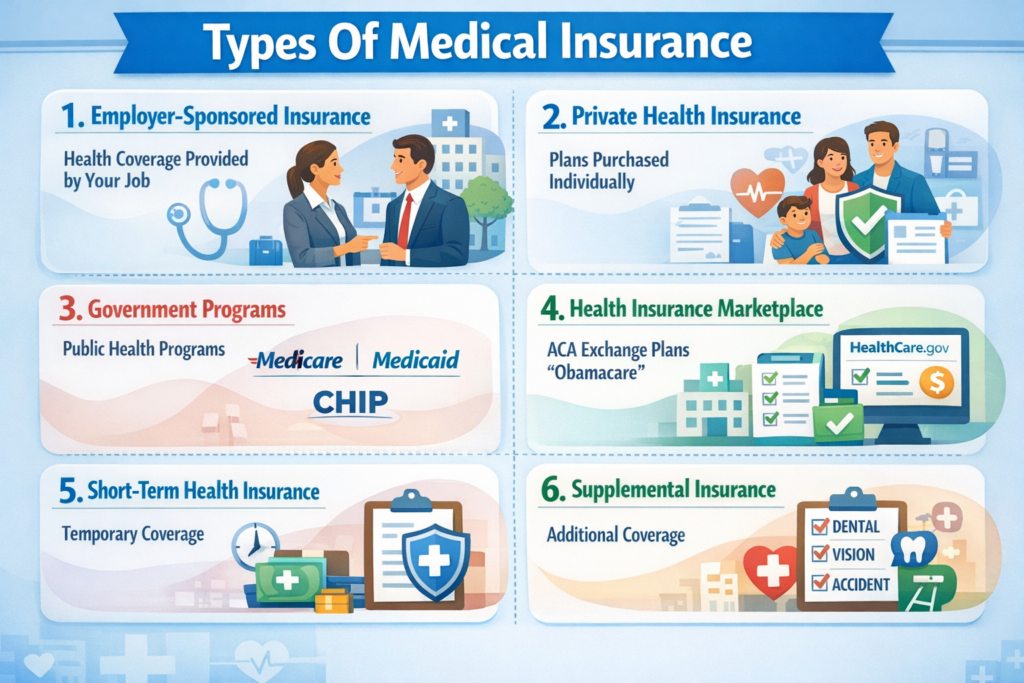

When drivers purchase car insurance in Florida, they often hear the phrase “no-fault insurance.” Many people do not fully understand what no-fault insurance means or how it affects them after an accident. In Florida, the no-fault system has unique rules that influence how medical bills and accident claims are handled. Understanding these details can help residents make informed decisions about their coverage. In this article, you will learn what no-fault insurance is, how it works in Florida, and the benefits and drawbacks for policyholders. By comparing it to other types of medical coverage, you can better appreciate its advantages and limitations. Reading further will give you the knowledge to protect yourself and your family on Florida roads. Understanding the Different Types Of Medical Insurance is a must.

Understanding No-Fault Insurance in Florida and Different Types Of Medical Insurance

No-fault insurance in Florida refers to a specific legal requirement for drivers. Under this system, each person’s own insurance pays for their medical expenses after a car accident, regardless of who caused it. Because Florida is a no-fault state, every driver must carry Personal Injury Protection (PIP) coverage. PIP coverage helps ensure that accident victims receive prompt medical care without long legal battles over fault. As a result, claims for minor injuries are settled quickly and efficiently. Knowing that this system and the different types of medical insurance are in place provides peace of mind for many drivers.

Additionally, no-fault insurance aims to reduce the number of lawsuits related to car accidents. Instead of seeking payment from the other driver’s insurance company, people turn to their own insurer for help. This shift simplifies the claims process and reduces the burden on the court system. In Florida, the law requires each driver to purchase at least $10,000 in PIP coverage. Since every car owner must comply, it creates a uniform approach to handling accident-related injuries.

However, no-fault insurance only applies to medical expenses and certain other costs, not to vehicle damage. Property damage claims still follow the traditional at-fault rules, where the driver who caused the accident is responsible. This distinction is important for anyone considering how much coverage to buy. Understanding the boundaries of no-fault insurance helps drivers make better choices about their policies. For many, it is crucial to understand exactly what is and is not covered under Florida’s law.

Key Features of Florida’s No-Fault Insurance System

Florida’s no-fault insurance system centers around Personal Injury Protection. PIP coverage pays up to 80% of medical bills and 60% of lost wages after an accident. In most cases, coverage is limited to $10,000 per person, per accident. This coverage also extends to children, certain passengers, and household members who do not own a car. If you are involved in an accident as a pedestrian or bicyclist, your PIP policy may still protect you. Because of these features, PIP offers broad protection to many individuals.

Another key feature concerns the types of medical treatments covered. PIP generally pays for hospital care, surgery, rehabilitation, and certain other health services. However, policyholders must seek treatment within fourteen days of the accident for benefits to apply. This rule encourages prompt medical attention and helps prevent fraudulent claims. When policyholders use their PIP benefits correctly, they often avoid delays in getting the care they need. Therefore, it is important to know the deadlines and requirements.

Despite its broad protection, PIP does have its limits. For example, PIP does not cover damage to your car. Nor does it cover pain and suffering unless the injuries are considered severe. The law defines severe injuries as permanent or resulting in significant loss of bodily function. Only when injuries meet these standards can someone sue the at-fault driver for additional damages. As a result, many people choose to buy extra insurance or uninsured motorist coverage for greater protection.

How No-Fault Insurance Affects Accident Claims

No-fault insurance has a major impact on how people file accident claims in Florida. Immediately after a crash, both drivers report the incident to their own insurance companies. Because the system removes the question of fault for medical expenses, claims are processed quickly. Insurance companies pay valid claims up to the limits of PIP coverage, often within thirty days. This speed benefits drivers who need medical care right away. For minor injuries, the process is much simpler than in states with no-fault rules.

However, not every situation is straightforward under the no-fault system. If injuries are serious or costs exceed PIP coverage, complicated issues can arise. In those cases, injured people may still need to sue the other driver for additional compensation. The law allows lawsuits only for specific situations, such as permanent injuries or fatal accidents. Because of these strict guidelines, most minor claims never reach the courts. That means less time spent in legal disputes and more focus on recovery.

Even with these benefits, some drivers find the no-fault process confusing. Deadlines for filing claims and following up with medical treatment are important to remember. If you miss a deadline or fail to provide the required documents, your claim could be denied. Therefore, it is essential to keep records and communicate clearly with your insurer. Taking these steps helps ensure that you make the most of your no-fault coverage in Florida.

Benefits and Limitations for Policyholders

No-fault insurance offers several advantages for Florida policyholders. Because your own insurance pays for medical costs, you receive treatment faster. There is no need to wait for the other driver’s insurance to accept blame or settle the claim. This prompt access to care can make a big difference in recovery, especially after a stressful accident. Many drivers feel more secure knowing they are protected regardless of who caused the crash. For families, PIP coverage can be a vital safety net.

Still, no-fault insurance has clear limitations. The ten-thousand-dollar cap on PIP benefits may not be enough for serious injuries. Once you reach the limit, you are responsible for any remaining costs unless you have other insurance. Additionally, PIP does not pay for pain and suffering unless your injuries meet strict legal standards. Because of these limits, some people may face large medical bills after a major accident. Insurance companies often encourage customers to buy extra coverage for greater protection.

Furthermore, the no-fault system does not cover all types of damage. Property damage is not covered under PIP benefits and is subject to traditional insurance rules. To protect your car, you must carry property damage liability or collision coverage. In some cases, drivers may need uninsured motorist coverage if the at-fault driver is uninsured. For many Floridians, understanding these gaps helps them make better choices about what policies to buy. Knowing the benefits and limitations of no-fault insurance is essential for every driver.

Comparing No-Fault Insurance to Other Medical Coverage

When you compare no-fault insurance to other medical coverage, several differences stand out. Health insurance policies generally pay for a wider range of medical treatments, regardless of the cause. Unlike PIP, health insurance does not have a fourteen-day deadline for treatment after an accident. For many people, health insurance covers expenses that PIP does not, such as follow-up visits or long-term therapy. Still, PIP pays right away and does not require deductibles or co-pays for covered services. Because both types of insurance have value, many choose to carry both.

Another important comparison involves traditional liability-based auto insurance. In states without no-fault laws, accident victims usually have to prove fault before getting any payment. This process can be slow and complicated, especially if there is a disagreement about who caused the crash. No-fault insurance in Florida allows people to avoid these delays for minor injuries. For major injuries, however, both systems often end up in court to resolve disputes over damages.

Despite its advantages, no-fault insurance is not a complete substitute for health or disability insurance. Each type of coverage offers unique benefits and has its own rules. Combining PIP with other insurance can give drivers the best protection against high medical costs and lengthy claims processes. Therefore, Floridians should carefully review all their options before deciding what insurance to purchase. By understanding the differences, you can build a coverage plan that fits your needs.

Conclusion on Different Types Of Medical Insurance

Understanding Different Types Of Medical Insurance in Florida is essential for anyone who drives in the state. The system requires every driver to carry Personal Injury Protection, which pays for medical expenses after an accident regardless of fault. Because PIP offers immediate benefits, many people receive faster access to care and do not need to wait for fault to be determined. However, the coverage limits and specific rules about which expenses are covered leave some policyholders with unmet needs. In cases of severe injuries, the law allows for lawsuits, but only under strict conditions.